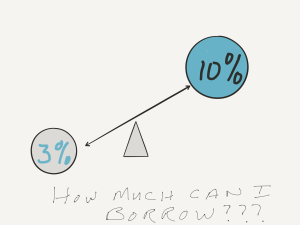

Leverage – the magic word of the day. Often heralded in financial text books. Using leverage you can amplify your returns. It is usually presented in simple math terms such as your cost of capital is 3% and your return on capital is 10%, blah blah blah….. Yes, that is a no brainer. Go get that 7% spread all day long. Then it is just a question of how much money can I borrow to capitalize on that spread?????

But there is often a missing element in this discussion. Risk. It is presented as if both variables are known and fixed. This is seldom true. You can’t ignore all of the possible ways that this equation can change, or ways that you have the equation wrong. The return that you plan for on paper isn’t always what happens in reality.

Reality

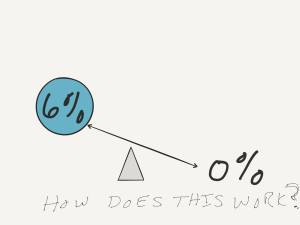

Every accountant knows that turning that projection into a reality is no easy task. All sorts of things get in the way. Way too many small businesses hover around the breakeven point. Then if your cost of capital is 6% how will you ever repay it? Loan repayment comes from after-tax profits. Without that, you will be perpetually in debt. Even if you don’t see this as a risk, I can guarantee that your banker will.

Risk

So what can go wrong? If your cost of capital of 3% and you can get a return of 10% that is a no brainer move…unless

- The cost of capital isn’t fixed

- The loan is callable

- Your return isn’t guaranteed

- Your lender is unstable

- Your return is based, in part or whole, on a tax provision remaining as is

- Your market changes

- Your customers change

These are just a few things that I have seen derail the equation. But that doesn’t necessarily mean you shouldn’t ever borrow money. What it does mean is that you should be aware of the risks and look for every way possible to minimize that risk. Think about how you could adapt to different scenarios. What changes would you need to make for the equation to still work? It is a mistaken belief that entrepreneurs like taking risk and that is what it’s all about. Successful business owners are aware of the risk they are taking and make every attempt to mitigate that risk.

A lesson from the Stoics

Stoic philosophy, I believe, is making a comeback. I heard it referenced frequently as a tool for creating a better life. My reaction when I first started hearing people talk about it was, “really”??????? I had a common misperception of what it really was. I thought the Stoics were people that just endured hardships and led grim lives. But really, they were seeking joy.

What I have taken from their philosophy is the idea of thinking about all the negative things that could happen. Not because you want to depress yourself, but rather to prepare yourself. Thinking about how you could handle these negative events helps in a couple of ways. First, it gives you a plan of action that you could take that is thought through when you aren’t in the emotions of the moment. It keeps you from making a rash decision. The second benefit is that it gives you confidence that you can and will weather difficulties. It makes you less afraid of the future because you are confident that it won’t take you down.

The future is unknowable

This is a recurring statement that I make. I keep repeating it because it seems that this is such a common trap that people fall into. There are really two ways that they fall in. The first is thinking that the current trend will continue into the foreseeable future. This is what created the real estate bubble. The more prices rose, the more people believed that they would continue and they were afraid of missing out which fueled it even more…until suddenly the bubble burst. The second trap is thinking you know what is going to happen. Many people were convinced that Y2K was going to create a stock market crash. They would state that you should convert everything to cash like that was a clearly prudent thing to do…and then it was a nonevent.

The ground is shifting

There is a huge shift going on in almost every industry and every job. The shift from the industrial age to the information age…or wherever it is that we are going towards…is in full swing. Can you feel the ground shifting beneath your feet? Robots and software are eating jobs. The sharing economy is in full swing. Millennials want a completely different way of living than Baby Boomers. Something that seems like a given today could be completely gone tomorrow. Just look at this list of things that Ray Kurzweil is predicting in a relatively short time period. How many iterations will your business need to make in the next 10 years. Givens are no longer a given.

Mental Clarity

How much stress is your debt causing you? If you are making that 7% spread we talked about earlier, then it probably isn’t causing any stress. But if your returns haven’t been greater than the cost of capital consistently, the answer is probably different. Or there could just be the uncertainty of your cash flow that causes you stress. How does that effect other decisions that you make in your business? How does that effect your overall satisfaction with your business? How do you factor that into the equation?

Not such an easy calculation

Leverage amplifies results…on both sides of the equation…for better or worse. That’s great when things are going in the right direction. But when the factors change and the things turn south, it amplifies that too.

Comments

Share this Post