Having debt is simply a manifestation of the fact that you have taken more than you have given. That is how I think about debt. When I first heard someone express debt in this way, it made me think. The way then to pay down debt is to reverse this concept and give more than you take. Frequently, we get into the mindset of debt being a burden, which it very well can be if the reason you are in debt was to acquire things that aren’t really of value.

Let’s look at the different categories of expenses. I talked about these categories in another post that you can read here.

- Destructive – expenses that are wasteful and should be eliminated

- Life style – spending that gives you joy

- Protective – protects what you have

- Rainmaking/productive expenses – helps you make more money

If you have used debt for the first three categories, then it may in fact feel like a burden. You have indentured your future.

But if you are truly making an investment in the future, debt is a tool that can enable you to give more in the future.

Before you run out to talk to your banker, let me caution you. Debt adds risk. Even if you want to borrow the funds for productive expenses, you need to understand the additional risk. How sure can you be that this additional expense will in fact lead to an increase in the bottom line? How much of an increase will it have? What events could change your assumptions? These are just a few of the questions you need to consider.

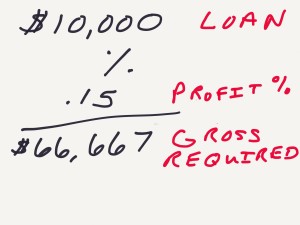

The next consideration is how much money will it take to pay off the debt. If you borrow $10,000 to purchase a piece of equipment, mentally most people think they just need to make an additional $10,000 to pay off the loan. But that is a huge mistake. It will take you more than that……….not to mention the interest that you will need to pay. How much more do you need to make? Let’s take a look.

If you have an additional $10,000 in sales, not all of that goes to the bottom line. You have your cost of sales and any related overhead costs. But even if you have an additional $10,000 in net profit, that won’t be enough either. You will owe taxes on that $10,000 in profit. What you really need is an additional $10,000 in after tax profits.

So, let’s reverse engineer this concept in very simple numbers. Let’s say that you have a solid after-tax profit of 15%. You will need more than $66,000 in additional sales to pay down your $10,000 in debt.

Maybe you can reduce this because this piece of equipment is going to make you more profitable, but the key takeaway here is that debt can only be reduced with after-tax profits.

That is why debt can be so difficult to pay back. Our mind thinks $10,000 but reality is we need to make so much more for it to be paid back. That is why so many people find themselves in trouble with debt.

So where does gratitude come into the picture?

When you are struggling with debt, it is easy to get into having a pity party for yourself. I would encourage you to think in terms of gratitude. Think about the opportunity that you have because of that debt. What do you have today that you didn’t have before? You were given that opportunity by taking on the debt. Now, you need to think about how you can use that asset to give back and be grateful for the opportunity.

If you are struggling with finding the gratitude, that gives you an opportunity too. If you can’t feel grateful, perhaps it is because you feel like you made a mistake taking on the debt. Maybe it isn’t paying off as you had anticipated or hoped. You can always feel grateful for the lesson. Regardless, the only way to pay it back is to give more. And I think that is always a winning strategy.

How can you give more to your customers today?

Comments

Share this Post