If you are looking at the pile of receipts that you have and wondering how you are ever going to get things organized, this blog post is for you. Many business owners are intimidated by accounting and think the task is just too overwhelming so they put it off. But this only makes the mountain higher to climb. And if you try to bring that hot mess in to your accountant to make sense of it you might as well hand over your first born for payment…….if they will even do it at all. Don’t pay an accountant premium prices to do clerical work. That is one of the rules of thumb that you should always use……..pay for the level of service you need….not more….not less. So now what do you do? Here is a step by step process to get that mess that has been causing you so much stress off your desk and put it into something you and your accountant can work with.

So how do I start?

Gather that pile of receipts and lets try to start making some sense of it. The first thing I do is pretty simple…….you can even enlist your kids……or the neighbors kids to help….pay them in cookies….just kidding. Take each receipt and tape it to a standard piece of paper. This seems silly if you have never done it but it is an important first step. It makes everything the same size and much easier to handle. You can also make notes on the page and it makes them easy to scan in the end if you want to convert all this to digital.

Next?

Print out your bank activity for the year (or what ever time period you are trying to organize). Or you can just gather your statements if you have them. I am assuming that you have a separate bank account for your business and personal expenses…….if this isn’t the case, this part will be a lot harder……put getting a business bank account on you high priority to do list!

And then?

It is just a matching game…….match the receipt to the line on the bank statement. It probably helps if you start by putting the receipts in date order. Then make a check mark on the bank statement for each receipt that you have. You will do the same with the income items……do you have the invoice you sent? Or sales receipt? Can you identify how and why you received that money?

Now what?

Look for anything you haven’t checked off. Do you have those receipts or invoices somewhere else? What if you can’t find them? If this is your first effort at accounting, this will be your wakeup call about how well you have been keeping track of things and how it is way more difficult to do as more time passes. It is just easier to track that stray receipt from last week than last year. It isn’t the end of the world if you don’t have it but you are at risk of having the expense thrown out in an audit…………so recognize that those receipts are valuable. Not keeping them is like throwing money away. Who can afford to throw money away?

Are we done yet?

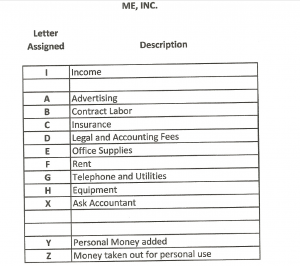

Not quite. Now you just need to figure out how to group the things that you spent money on. So you will be grouping together like kinds of expenses. If you need help figuring out what catagories to use, this will probably help. Pick out the ones you want to use and make a list and assign each category a letter. Just try to make it useful to you to identify where it was that you spent your money. The categories will vary based on the type of business you have. A helpful category you might want to use can be called “Ask Accountant”. This is where you would put anything that you don’t really know where it fits. Then you can just go through these couple of things with your accountant and get them in their right place.

Hang on…..we can make it

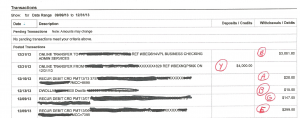

Then assign a letter to each item on your bank statement……..see the picture below. So as you go through this, you might have some things that don’t seem to fit. Things like putting money in the account from you personal funds to keep things going. Or you might have taken money out to put in you personal account. You can see that I made a separate category for these amounts. These aren’t considered income or expenses.

Then comes the ciphering…….

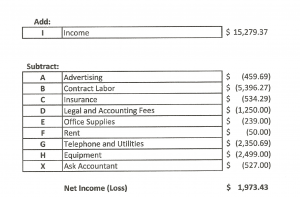

Add up all of the “A”s and enter it on your worksheet. Then do the same for each of the other letters until you have gone through all of the categories that you have identified. Then add up all of the expenses and subtract it from your income. You are done! ……..well almost.

Ok….let’s get ready to wrap this up

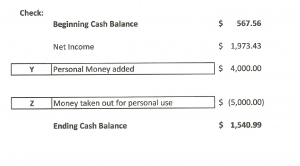

Now to check your math. Start with your beginning cash, add in your net income or subtract your net loss (expenses greater than your income), add any money you added to your account from your personal account, subtract any money you transferred to your personal account. This amount should be the same as your ending bank balance. If it isn’t, you likely have a math error or you missed something. So you will need to do some double checking.

There are all kinds of ways of automating this whole process but if you don’t have a lot of activity in your business yet, you can make do with this type of system for now. At some point, it will make sense to hire a bookkeeper or get a full fledged accounting system. Until then, this one will get the job done. Now you are ready to sit down with your accountant and go over the few things you didn’t know how to handle and ask any question. Congratulations!

Comments

Share this Post